42 items purchased with gift card tax deductible

Are Business Gifts Tax Deductible? 7 Rules for Clients and ... - Keeper Tax Normally, they're only 50% deductible. Rule #2: Gifts to clients must be under $25 per person, per year That's right, no diamond necklaces or top-of-the-line gaming consoles this year. If you want your client gift to count as a business expense, you'll need to keep the price low. Why just $25? Is Interest on Credit Cards Tax Deductible? - TurboTax OVERVIEW. The IRS allows you to deduct certain expenses from your total income to arrive at taxable income, which is the portion of your earnings that is subject to tax. Some of these expenses include your payments of interest on a mortgage and for business loans. However, when you use a credit card for personal purchases, the interest you pay ...

Are gifts to clients and employees tax-deductible? Non-cash gifts to employees valued at less than $75 are not taxable to the employee and can be a business expense deduction. There is a tax-free limit of $1,600 for all awards given to each employee in the year. This $1,600 limit does not include gifts awarded for length of service or safety achievements, so long as they are not cash or gift cards.

Items purchased with gift card tax deductible

Supplies, Pet Food, and Pet Products | Petco 35% Discount Exclusions: ORIJEN, Milkbone, Select Royal Canin, Purina, Feline Pine, Select Royal Canin, select Pet Pharmacy, select cat litter, WholeHearted Memberships, addon items, out-of-stock items, Donations, Petco Gift Cards and eGift Cards; and applicable taxes. Additional exclusions may apply and will be noted on the Product Detail page ... 25 Small Business Tax Deduction You Should Know in 2022 - FreshBooks You can write off office supplies including printers, paper, pens, computers and work-related software, as long as you use them for business purposes within the year in which they were purchased. You can also deduct work-related postage and shipping costs. Be sure to file all receipts for office supply purchases, for documentation. 7. The Perfect Gift: Tax-Deductible Charitable Gift Cards that Never ... After every purchase, TisBest sends an itemized receipt to the Charity Gift Card purchaser. The tax-deductible donation happens when the Charity Gift Cards are purchased, but they can be given and redeemed anytime and never expire. Once "spent" by the giftee, 100% of the gift card value goes on to their charities of choice.

Items purchased with gift card tax deductible. IRS Schedule C Tax Deductions & Expenses for Small Business Owners Payments to contractors, freelancers, or other small-business people can go on Line 11. You must send Form 1099-NEC to those whom you pay $600 or more. Before 2020, you would have reported those payments on Form 1099-MISC. You must send a copy of the 1099-NEC to the IRS. Legal, Accounting, or Professional Service s. Charitable Deductions On Your Tax Return: Cash And Gifts - e-File Attention: For your 2021 tax return, you can have a charitable deduction of up to $300 or $600 for married couples filing jointly made during 2021, even if you don't itemize. The gift must go directly to charity in cash rather than to a donor-advised fund or private foundation. How Realtors Maximize Tax Deductions on Gift Cards On the other hand, if you purchase a Tim Hortons' gift card (restaurant) or a No Frills' gift card (grocery store), you may spend $100, but you only get to deduct $50. Only 50% is tax deductible. So… when you are selecting your client gift card to your clients this year, you know which ones give you maximum deduction! How Sales Tax Applies to Discounts, Coupons & Promotions The state of Texas offers the following example of how it applies sales tax to this type of promotion: A retailer advertises pants as "buy one, get one free.". The first pair of pants is priced at $120; the second pair of pants is free. Tax is due on $120. Having advertised that the second pair is free, the store cannot ring up each pair of ...

FAQ: Are Gift Cards for Employees a Tax Deduction? - Level 6 Incentives In other words, you can give an employee a $400 watch as an award for length of service with the company, and the value of that watch can be tax-deductible. However, you cannot award them a $400 gift card and write that off; as money, it must be reported as income. As the IRS says: › donateDonate - PayPal ©1999-2022 PayPal, Inc. All rights reserved. Privacy. Legal. Policy updates ... › corporate-gift-ideasCorporate Gift Ideas for 2022 - godelta.com Are corporate gifts tax-deductible? Yes, corporate gifts are tax-deductible. According to the IRS, your business can deduct up to $25 per person per year for corporate gifts. This limit only applies to gifts to individuals. Company-wide gifts are deductible in any amount, though there are exceptions. A List of 77 HSA-Eligible Expenses for 2022 - GoodRx The following 18 items are examples of now-qualified medical expenses: Acne treatments Allergy medication Aspirin Band-Aids Breathing strips Cold and cough medicine COVID-19 tests Eye drops Heartburn medications Ibuprofen Liners Menstrual cups Nasal sprays Pads Period panties Sleep aids Tampons Thermometers

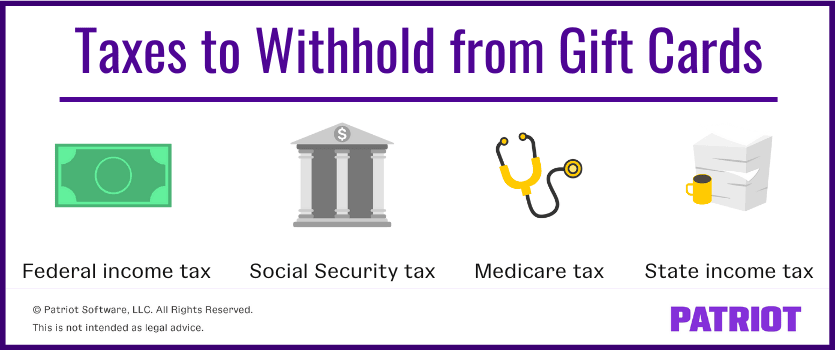

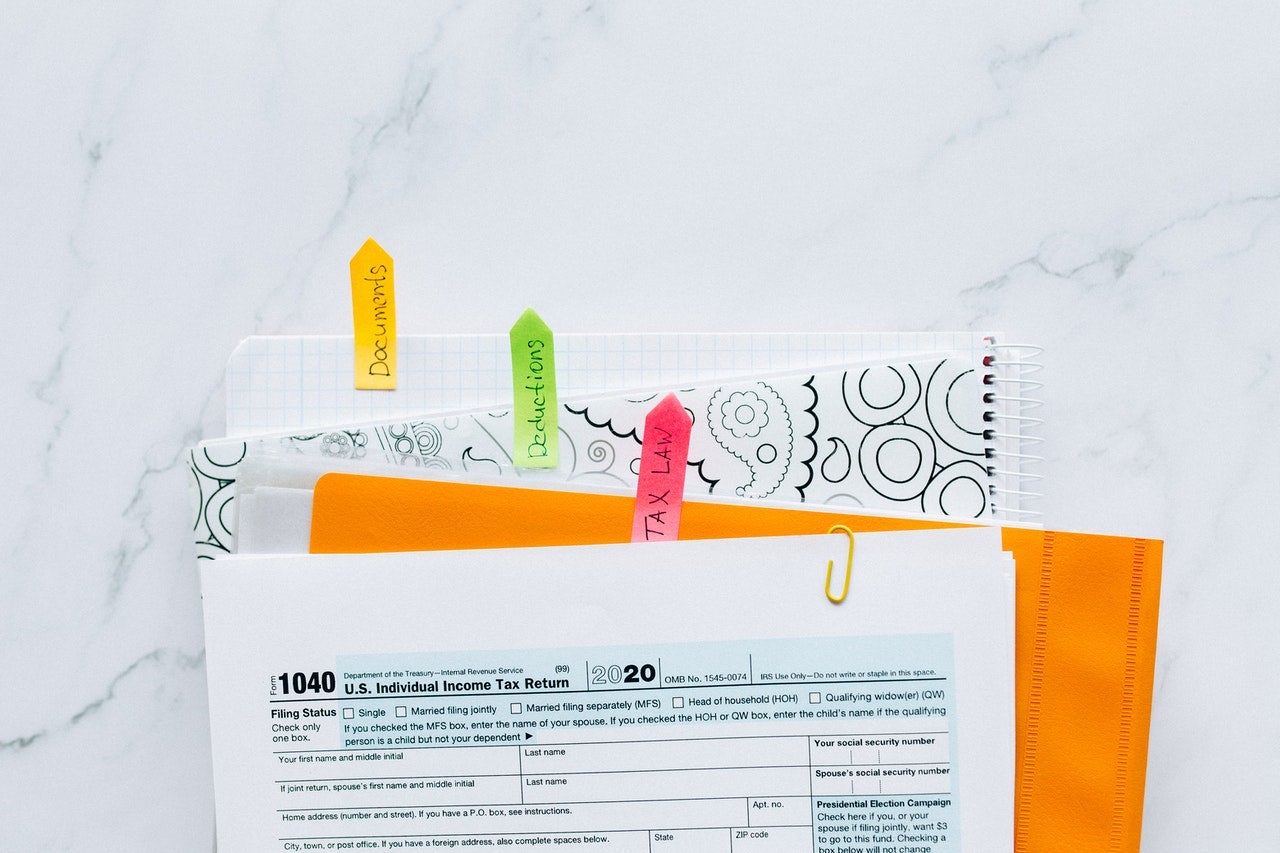

Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software Are gift cards taxable? Yes, gift cards are taxable. According to the IRS, gift cards for employees are considered cash-equivalent items. Like cash, include gift cards in an employee's taxable income—regardless of how little the gift card value is. But, there is an exception. › publications › p334Publication 334 (2021), Tax Guide for Small Business Getting tax forms, instructions, and publications. Visit IRS.gov/Forms to download current and prior-year forms, instructions, and publications. Ordering tax forms, instructions, and publications. Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The ... 53 tax deductions & tax credits you can take in 2022 Low-income taxpayers can deduct up to 50% of their contributions to a SIMPLE, SEP, traditional or Roth IRA, 401 (k), 403 (b), governmental 457 (b) plan, or ABLE account. The maximum saver's credit available is $4,000 for joint filers and $2,000 for all others. Use Form 8880 and Form 1040 Schedule 3 to claim the saver's credit. How do you define "major purchase" or "major item" for the sales tax ... When we ask if you bought any major items while living in your state, answer Yes if you purchased:. A motorized vehicle (car, truck, RV, motorcycle, etc.—sorry, no mopeds).; An aircraft, boat, mobile home, or manufactured home, but only if you paid the general sales tax rate (otherwise it doesn't apply).; Building materials for a major renovation or substantial addition to a home, if you ...

LLC Tax Deductions Guide (What Expenses Can You Write Off?) There are tax benefits to writing off certain business expenses on your income taxes as an LLC. As an LLC, you can write off a variety of expenses related to running your business. This can include office supplies, advertising costs, and travel expenses. The business expense must be considered "ordinary and necessary" for your business to ...

Charitable Contributions You Think You Can Claim but Can't That pledge you made doesn't become deductible until you actually give the money. When you agree to contribute $10 per month during a fund-raising drive, only the monthly payments you make during the tax year can be deducted on that year's return. You cannot claim $120 if you only paid $40 during the year. The gift that's not a gift

Are used items I purchased off Craigslist for my b... Why sign in to the Community? Submit a question; Check your notifications; Sign in to the Community or Sign in to TurboTax and start working on your taxes

Must-Know Tax Rules for Employee Gift Cards: 2022 Update - Giftogram That's because all gifts to your employees and customers, whether gift cards, cash, non-monetary gifts, or bonuses are tax deductible. Not to mention, when you appreciate your employees and customers year-round, they love you back through their loyalty. Stock up on relationship-building rewards for your business today. Non-Taxable Employee Gifts

Which College Education Expenses Are Tax Deductible | H&R Block Such expenses must have been required for enrollment or attendance at an eligible educational institution. The deduction was 100% of qualified higher education expenses with a maximum of $4,000, $2,000, or $0, depending on the amount of your modified AGI and filing status. The phaseout for this deduction began at $65,000 ($130,000 for MFJ) for ...

› financial-edge › 0411Donations: 5 Ways To Maximize Your Tax Deduction - Investopedia Apr 27, 2022 · Charitable giving can help those in need or support a worthy cause; it can also lower your income tax expense. Eligible donations of cash, as well as items, are tax deductible, but be sure that ...

Are Gifts Tax Deductible? Gifts can be tax deductible but only for a very certain amount of things. Gifts are tax-deductible if they fall within the certain dollar limit determined yearly by the IRS. This limit is called the annual exclusion amount and this changes every year to keep up with inflation. To keep up to date with the annual exclusion amount you can find the ...

› publications › p530Publication 530 (2021), Tax Information for Homeowners You can prepare the tax return yourself, see if you qualify for free tax preparation, or hire a tax professional to prepare your return. For 2021, if you received an Economic Impact Payment (EIP), refer to your Notice 1444-C, Your 2021 Economic Impact Payment.

The Perfect Gift: Tax-Deductible Charitable Gift Cards that Never ... After every purchase, TisBest sends an itemized receipt to the Charity Gift Card purchaser. The tax-deductible donation happens when the Charity Gift Cards are purchased, but they can be given and redeemed anytime and never expire. Once "spent" by the giftee, 100% of the gift card value goes on to their charities of choice.

25 Small Business Tax Deduction You Should Know in 2022 - FreshBooks You can write off office supplies including printers, paper, pens, computers and work-related software, as long as you use them for business purposes within the year in which they were purchased. You can also deduct work-related postage and shipping costs. Be sure to file all receipts for office supply purchases, for documentation. 7.

Supplies, Pet Food, and Pet Products | Petco 35% Discount Exclusions: ORIJEN, Milkbone, Select Royal Canin, Purina, Feline Pine, Select Royal Canin, select Pet Pharmacy, select cat litter, WholeHearted Memberships, addon items, out-of-stock items, Donations, Petco Gift Cards and eGift Cards; and applicable taxes. Additional exclusions may apply and will be noted on the Product Detail page ...

/dotdash-050415-what-are-differences-between-debit-cards-and-credit-cards-Final-2c91bad1ac3d43b58f4d2cc98ed3e74f.jpg)

![H&R Block Tax Software Deluxe 2021 with 3% Refund Bonus Offer (Amazon Exclusive) | [PC Download]](https://m.media-amazon.com/images/I/51MrXpjW5hL._AC_SX679_.jpg)

0 Response to "42 items purchased with gift card tax deductible"

Post a Comment