38 accounting for gift card breakage

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Accounting for Gift Cards - Journal of Accountancy EXECUTIVE SUMMARY The accounting for gift card sales presents an emerging reporting dilemma for retailers. Unresolved reporting issues stemming from the reporting treatment of gift card sales and “breakage” (gift cards that consumers fail to redeem) potentially involve several accounting regulations, including standards for revenue recognition and the recognition of

US Retail Gift Card Accounting Guidelines: ASC 606 - Coresight Research We also cover retailers' unused gift card liabilities, including Amazon, Target and Walmart, and how outstanding gift cards are managed in the event of retailer bankruptcies and liquidations. Click here to read our report on key trends impacting the US gifting market. CONTENTS What's the Story? Why It Matters Gift Card Accounting: In Detail

Accounting for gift card breakage

Gift Card Breakage - (ASC 606) - Audit Analytics The Breakage Rate Based on SEC filings, the breakage rate (breakage revenue as percentage of gift card sales) is typically 2-4%. The rate could vary from retailer to retailer and depends, among other things, on whether the nominal value of the card is sufficient to complete a purchase. Gift Card Breakage Accounting Quick and Easy Solution Gift Card Breakage Accounting will sometimes glitch and take you a long time to try different solutions. LoginAsk is here to help you access Gift Card Breakage Accounting quickly and handle each specific case you encounter. Furthermore, you can find the "Troubleshooting Login Issues" section which can answer your unresolved problems and ... Accounting for Gift Cards: A Demonstration of the Need for a New ... Figure 6 Gift Card Breakage Recognition Rate .47 Gift Card Liability and Breakage using the Percent Reduction Method, Increasing Gift Card Sales ... companies' gift card accounting practices vary to a large extent. The revenue that results from gift cards going unredeemed, also known as "breakage" revenue, has the potential ...

Accounting for gift card breakage. Accounting for gift cards — AccountingTools The essential accounting for gift cards is for the issuer to initially record them as a liability, and then as sales after the card holders use the related funds. There are varying treatments for the residual balances in these cards, as noted below. Liability Recognition Gift Card Breakage Accounting - GBQ A tricky part of gift card accounting is the "breakage analysis" which can result in revenue recognition before a gift card is redeemed in full. Often, gift cards are left fully or partially redeemed which triggers "breakage rules" in accordance with ASC 606-10-55-48. FASB Rules on Recognizing Breakage for Prepaid Cards Mar 14th 2016. A new standard issued by the Financial Accounting Standards Board (FASB) on March 10 provides guidance on how entities that issue certain prepaid stored-value products should recognize breakage - the dollar value that is not redeemed by cardholders. Accounting Standards Update (ASU) No. 2016-04, Liabilities—Extinguishments of ... Accounting For Gift Cards - UWorld Roger CPA Review Historical estimates of breakage by consumer research groups estimate that between 10-19% of gift cards are never redeemed. With $27.8 billion in gift card purchases reported in 2006, one can easily see the impact these unredeemed cards can have on a retailer's statements. Cards have a positive effect on the retail sector, of course, because ...

What Do You Know About Gift Card Accounting? - QuickBooks Typically, you can account for breakage by looking at trends from previous reporting periods. For instance, if your clients sold $1,000 in gift cards last year and only redeemed $800, the breakage rate is 20%. Because you know a portion of all sold gift cards is likely to remain unused, you can account for those amounts immediately ... Gift card - Wikipedia Mobile gift cards are delivered to mobile phones via email or SMS, and phone apps allow users to carry only their cell phone.. Virtual gift cards are delivered via email to the recipient, the benefits being that they cannot be physically lost and that the consumer does not has to spend the additional time needed to buy a physical gift card in a brick and mortar store making it more convenient. Accounting For Gift Cards | Double Entry Bookkeeping Mar 01, 2021 · Redemption: Customers redeem the gift card in return for products. Breakage: Some gift cards are not redeemed and ‘expire’ (referred to as breakage). Gift Cards Sale. Gift cards are sold to the customers (usually in return for cash), and the business must establish the liability for its obligation to supply the customers with goods in the ... Recognition of Breakage Revenue Under the New Revenue Recognition ... In addition, ABC needs to recognize $40 of breakage revenue and reduce the gift card liability by the $40. This is calculated as $400/$1,000 (the percentage of redemption) x $100 (the estimated total breakage) = $40. It is important to note that the legal requirements of unexercised customer rights vary from jurisdiction to jurisdiction.

Gift Cards: Great for Cash Flow, An Accounting Headache Once a gift card is redeemed, the liability is reduced, and revenue is recognized. Many consumers who forget to use these gift cards cause unexercised customer rights, also known as breakage and stale liabilities. Unexercised customer rights can cause significant obligations on a company's financial statements. What Is Breakage And Why Does It Matter? – Forbes Advisor Breakage Defined Breakage is an accounting term that identifies revenue recognized from services that are paid for but not used. The most familiar example of where breakage occurs is in gift cards.... Accounting for Gift Cards: Prepare for the Holiday Season - GBQ Revenue recognition and accounting treatment. Gift cards are sold for cash, are redeemable later, and are accounted for in accordance with ASC 606. The company cannot record revenue when the gift card is purchased since the company is obligated to provide service at a later date. Therefore, the income is deferred and recorded as an obligation ... Accounting for Gift Cards - YouTube Accounting for gift cards presents two issues: (1) when to recognize revenue and (2) what to do if some portion of the gift card is never redeemed (breakage...

Breakage Definition - Investopedia Breakage Solutions The Financial Accounting Standards Board (FASB) developed a new model for accounting for prepaid services and goods that addresses the breakage that goes along with selling these...

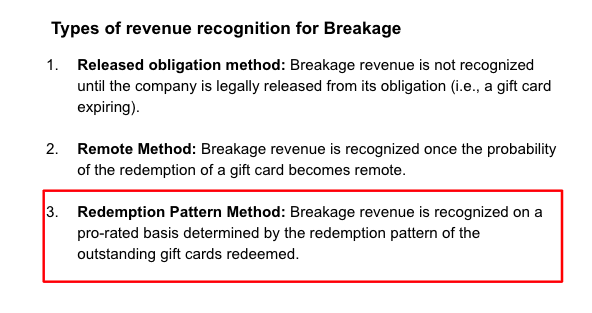

ASC 606 and Gift Card Accounting - Illumeo Accounting for Unredeemed Gift Cards - After ASC 606 ASC 606 provides companies with a new method for recording breakage as revenue and this method is called the proportionate method. According to the proportionate method, breakage revenue is recorded on a pro-rata basis in proportion to the amount of gift card redemptions.

Navigating the Gift Card Breakage Standards - BDO The FASB recently issued ASU 2016-04, Recognition of Breakage for Certain Prepaid Stored-Value Products, to address accounting for gift cards and other prepaid stored-value products that are not expected to be redeemed by customers.

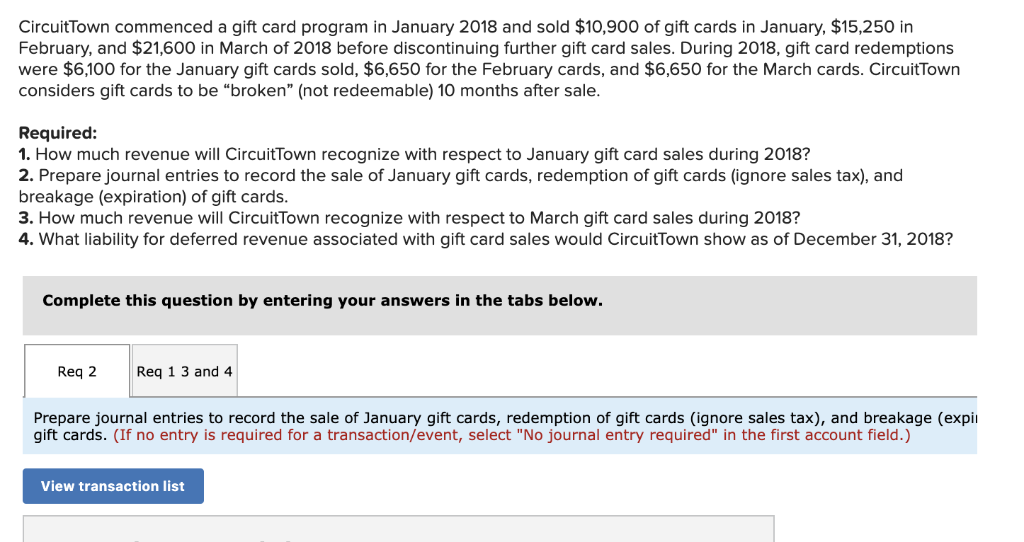

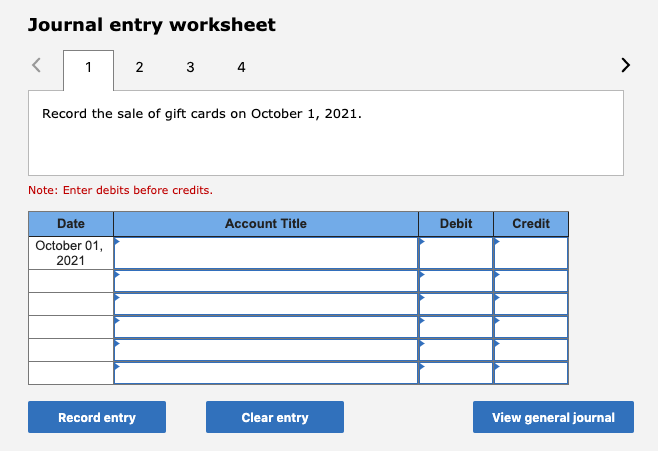

Gift Card Accounting, Part 1: The GAAP Standards Now, apply that percentage to the estimated amount of breakage to get the amount that needs to be recognized in January: 60 percent times $100 = $60 will be recognized. Here are the journal entries for these transactions: Sale of the gift cards in December: DR Cash: 1,000. CR Gift Card Liability: 1,000. Redemption of the gift cards in January:

7.4 Unexercised rights (breakage) - PwC This amount would be calculated as the total expected breakage ($5,000) multiplied by the proportion of gift cards redeemed ($22,500 redeemed / $45,000 expected to be redeemed). EXAMPLE RR 7-13 Breakage - customer loyalty points Hotel Inc has a loyalty program that rewards its customers with two loyalty points for every $25 spent on lodging.

Breakage definition — AccountingTools Breakage is that amount of revenue generated from unclaimed prepaid services or unused gift cards. The amount of breakage is difficult to estimate in advance, which can complicate the related accounting. Breakage results in pure profit for retailers, since there is no offsetting cost of goods sold. However, state governments sometimes claim ...

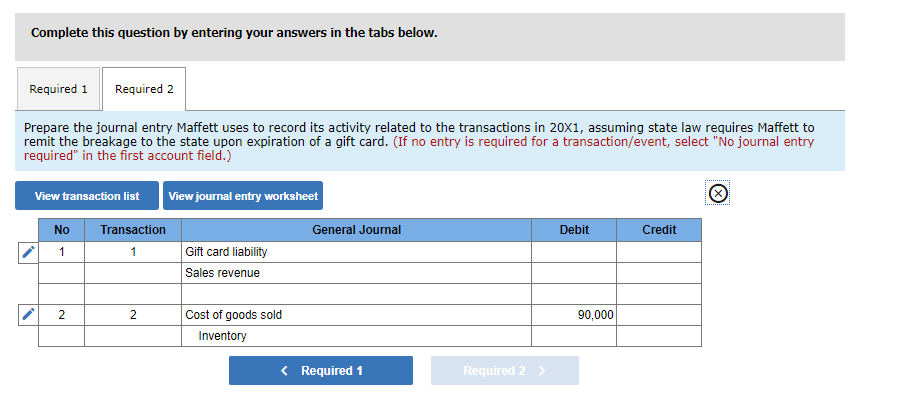

New revenue recognition standard: accounting for gift cards Gift card purchases during 20X1, totaled $500,000. Each year the accounting team obtained reports to determine the dollar amount of redemptions related to the gift cards purchased in 20X1. The breakage income of $50,000 (or 10% of gift card purchases) was recognized in proportion to redemptions, as shown in the table below:

Accounting for Gift Card Breakage: Changes on the Horizon? - ORBA The accounting is less clear, however, when consumers lose these gift cards, ignore them, or leave partial balances on the gift cards that have been used. In the gift card market, these unspent balances are referred to as "breakage" and gift card issuers want to know when they can write off the liability the breakage creates.

Revenue Recognition of Gift Cards Complications of Breakage Income Gift card sales for 2010 are currently estimated to have exceeded $200 billion, with $25 billion coming from holiday season spending. ... known as breakage, range from 10 to 19 percent. (Grant Thornton LLP., 2011) Accounting for breakage income will be the main topic of this paper. Revenue Recognition of Gift Cards . 4 . General Facts about ...

Accounting For Gift Cards Under IFRS 15 - Zampa Debattista To compute the adjustment to contract liability and revenue representing expected breakages, in this example we would calculate [Total Breakages * (Redemptions/Gift Cards Issued)], which is equal to €15 * €180/€300. The breakage estimate would typically need to be adjusted at every period-end, and adjustments would need to be made accordingly.

How to Handle Gift Cards in Your Accounting | ScaleFactor Apr 13, 2020 · In fact, many customers who use gift cards will spend 38% more than the funds on their gift card. Benefits of Gift Cards. Gift cards provide an influx of cash for your business while increasing your marketing opportunities. If a customer purchases a gift card and gives it to their friend as a gift, you can now direct your marketing to two ...

Lost and found: Booking liabilities and breakage income for unredeemed ... Furthermore, the sale of the gift card triggers revenue recognition of breakage income equal to 7.5% (i.e., $162 ÷ $2,160) of $240, or $18. However, the state where the customer lives requires that 60% of this breakage income (i.e., $10.80) be surrendered, leaving the company with only 40% of the expected breakage income (i.e., $7.20).

Accounting for Gift Cards: A Demonstration of the Need for a New ... Figure 6 Gift Card Breakage Recognition Rate .47 Gift Card Liability and Breakage using the Percent Reduction Method, Increasing Gift Card Sales ... companies' gift card accounting practices vary to a large extent. The revenue that results from gift cards going unredeemed, also known as "breakage" revenue, has the potential ...

Gift Card Breakage Accounting Quick and Easy Solution Gift Card Breakage Accounting will sometimes glitch and take you a long time to try different solutions. LoginAsk is here to help you access Gift Card Breakage Accounting quickly and handle each specific case you encounter. Furthermore, you can find the "Troubleshooting Login Issues" section which can answer your unresolved problems and ...

Gift Card Breakage - (ASC 606) - Audit Analytics The Breakage Rate Based on SEC filings, the breakage rate (breakage revenue as percentage of gift card sales) is typically 2-4%. The rate could vary from retailer to retailer and depends, among other things, on whether the nominal value of the card is sufficient to complete a purchase.

![Solved Exercise 13-9 (Algo) Gift Cards (LO13-3] CircuitTown ...](https://media.cheggcdn.com/media/aff/aff5bad8-dca3-484d-a0de-9b22e029607c/phpYJQRRt)

0 Response to "38 accounting for gift card breakage"

Post a Comment